During the first half of the 19th century in the Ottoman Empire, foreign banks began to operate within the country's territory in line with the adoption of Western models of trade and financing. At those times, there was not any sufficient capital accumulation for the establishment of a banking system having a national character, and it was not possible to speak of the existence of a national bank as a source build tool.

The section of the population who suffered from this situation was the farmers, which constituted the vast majority of the working population were. The agricultural sector had been completely abandoned to their fate and as a result, a large group of farmers facing financial hardship were constantly in need of loans provided by private individuals as there was not any corporate financial structure available to which they could apply for loans

Loaners were usually moneylender individuals who engaged with this business field, along with several traders and artisans such as merchants, wholesalers, exporters, brokers, agricultural middlemen, and village grocers, who also sold agricultural supplies. Such high-interest private borrowings were called Usurer or Pawnbroker Loans.

At those days, an annual interest rate of up to 900% would be involved on the basis of 1 Para per day calculation. Thus, being in extreme hardship to pay their debts, the farmers were forced to sell their products to these individuals even before the harvest. (so-called Selem Procedure).

The idea that the State should intervene with the agricultural lending business in order to find remedies to the problems of the downtrodden farmers was gradually finding its place in the newspapers of the time and in the official circles.

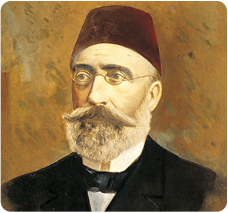

Mithat Pasha, the governor at that time of the Nis city in Yugoslavia, which was then under the ruling of the Ottoman Empire, had already achieved successful outcomes in various fields and also closely witnessed the severe conditions which the farmers had to face. As a result of his surveys, he concluded that an organization in that field was imperative and State aid was needed to help to rescue farmers from the hands of loan sharks but it was also important that such aid had to be supported by a public action. Thus, an organization called "Homeland Funds" was established by and under the auspices of the State in 1863, led by Mithat Pasha, utilizing the resources raised by the farmers. This initiative went down in history as the first example of the national banking and constituted the basis of today's Ziraat Bank.

When setting up the very first Homeland Fund in the Pirot Town (Şehirköylü Town) in 1863, Mithat Pasha was inspired by the collective work tradition (imece), which already existed among Turkish customs and which was based on mutual assistance principles.

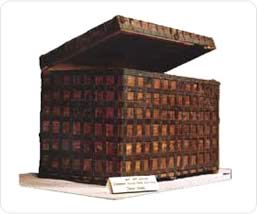

Homeland Funds took their name from the wooden crates employed. The regular affairs related with the Fund would be run by 4 Fund Custodians, consisting of 2 Muslim and 2 Christian citizens elected by the participant villagers. The journal containing the records of daily transactions, the general ledger and the cash in hand were all kept in these wooden crates. Later, for safety reasons, primitive safes made of iron by local craftsmen were employed instead of these wooden crates.

Upon the entry into force of the “Regulations on Homeland Funds" in 1867, these Funds started to operate throughout the Ottoman Empire (the Funds in Rusçuk, Eski Cuma ve Lefkoşe towns are among the first examples) and continued to serve successfully for many years.

A two thirds (2/3) portion of the profit of the Fund, which was obtained by the deduction of expenses from the incomes obtained as a result of lending operations, was used for the construction and repair works of the basic structures open for common use by public such as schools, roads, bridges in the region where the Fund was operated. In this respect, Homeland Funds also contributed to the development of the Country

However, the deteriorations observed in the operation of these Homeland Funds decreased their effectiveness. The government, considering that these adversities would be eliminated by placing them under the central administration, established "Benefit Funds" in 1883 for the same purposes. Upon the establishment of the Benefit Funds, their management was revised, recording and accounting procedures were carried out in accordance with modern and scientific principles and the Funds were subjected to the direct audit of the central government.

Although this new restructuring ensured a relatively serious management that was open to scientific audits, it did not obviate the need for an entirely new, contemporary organization.

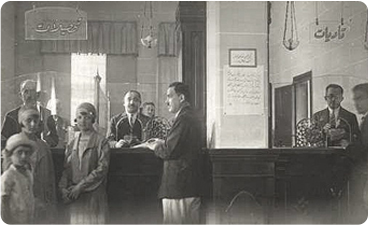

Thus; Ziraat Bank was officially established on 15 August 1888 as a modern financial institution to undertake the functions of the Benefit Funds, and the Benefit Funds operating at that time were converted into bank branches and started their operations. The shares that made up the financial resource of the Benefit Funds until then were transferred to the Bank and the shares issued subsequently were allocated to the Bank's capital. With this move, a new era began in our history of organized agricultural loans.

During the 1900s, the economy gradually deteriorated and the Ottoman Empire lost its lands first in Tripoli and then in the Balkans. The Great War emerging in Europe and spreading around the world was bringing the 600-year Empire to end.

During those hard times, a new law was enacted for Ziraat Bank on 23 March 1916. Article 1 of the Law reads as follows: “Ziraat Bank was established to provide facility to farmers and to help agricultural development". Ziraat Bank would be able to issue bonds for this purpose; to become a partner of the agriculture enterprises; to provide seeds, farm animals, farming tools equipments and similar materials and to deliver these supplies to farmers on cash or credit basis; and to distribute the lands it purchased to farmers when necessary.

Upon occupation of the capital of the Empire by the allied forces, a battle to survive was launched that will last about 3 years, under the leadership of Mustafa Kemal Pasha who stepped out to Anatolia part of the Empire upon the occupation. National Forces starting to be mobilized in Anatolia within the framework of the national struggle were in desperate need of financial support. In addition, it was also necessary to provide support to Finance Office, local governments and military troops which were deprived of adequate resources. At this very moment, cash aids were made by Ziraat Bank Branches and Funds against a bill of debt. Bank organization did not hesitate to put their heart and soul for financial assistance to this sacred struggle to the extent of their capabilities. Ziraat Bank rendered very important services to the Treasury during the War of Independence, and the gold deposits held in Istanbul were secretly brought to Ankara upon Mustafa Kemal’s directive. On the other hand, Ziraat Bank supported the War of Independence by also sending a large number of its staff to the front line.

With theses aids granted by the Agricultural Bank branches, it was aimed to provide as much contribution as possible not only to those who administered this holy struggle, but also to all the Turkish villagers who participated in the liberation movement.

While the Regulations on Agricultural Obligations issued under the directive of Mustafa Kemal Pasha set forth the principles of Bank’s aid to the families of farmers who were soldiers fighting at the front line, the task of distributing agricultural tools, equipments and seeds in the customs was also delegated to Ziraat Bank, routinely.

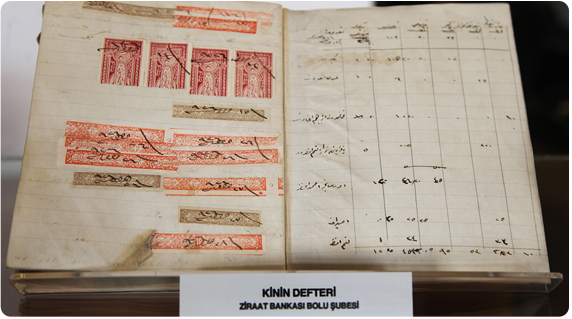

Ziraat Bank was delegated even with the task of disseminating "Quinine", which was the known most effective and only drug of the malaria, the most notorious disease of the time. The epidemic causing the loss of highest number of population in Turkey was Malaria, as it was throughout the World. Malaria epidemic reached catastrophic dimensions in 1924. Peasants abandoned their fields, sickles, threshing jobs. All the people in towns and cities, poor or rich, were affected by this disease. The government started to send the quinine to the countries to be distributed to the poor people as it was a drug used to ensure protection against malaria and to treat malaria patients. As quinine was supplied from abroad, the import of quinine was made by the Ministry of Health while Ziraat Bank assumed the task of distributing the imported quinines. The actual distribution of quinine was made by Ziraat Bank branches by keeping book records. Ziraat Bank employees, despite their very limited capabilities, made an extraordinary effort during and after the War of Independence in order to be able to fulfill in a complete manner the difficult tasks which they undertook.

The number of Ziraat Bank branches and funds which were assigned with the task of helping farmers increased from 110 to 300 in 1923. A capital of approximately 2 million TL was provided to the Bank in this period and Bank started to give large credits especially to the regions of the country freed from the enemy.

During 1920s, the country was mostly burnt, destroyed and in poverty, industrial enterprises which were already few in number before the war became inoperative, workbench production based on individual initiatives totally disappeared, and transportation almost came to a standstill. In order to help overcome these difficulties, the number of Ziraat Bank branches was increased and credit facilities were extended within a short period.

With the Ziraat Bank budget law enacted by the Parliament in March 1924, the Bank was transformed into a joint stock company.

Ziraat Bank made positive contributions of great extent in overcoming with minimal damage the serious adverse effects caused by the economic depression that swept the world in 1929 and by the ensuing 2nd World War. During these distressed times when even the bread was rationed, the State was implementing mandatory savings policy and was encouraging everyone to this direction. Ziraat Bank also offered several possibilities for deposits to encourage the people to save money. Also with the moneyboxes introduced for the first time, it was intended to raise a new, frugal generation. During the same years, various agricultural courses were also opened in collaboration with the Ziraat Bank, aiming to increase agricultural productivity by teaching new farming techniques to farmers.

Ziraat Bank acquired the status of a state-owned economic enterprise by a law adopted in 1937, whereby Ziraat Bank was granted with partial autonomy in its management in order to allow them to provide their services more conveniently. Under the same law, the Istanbul Security Fund that was established in 1868 by also Mithat Pasha in order to be transfer small savings to small investment were placed under the structure of Ziraat Bank.

After 1950, during which years the negative effects of the war decreased gradually, the resources and facilities of the Ziraat Bank were always taken into consideration when new initiatives were planned in agriculture in order to reconstruct villages and villagers.

The Bank, thanks to its management structure based on well-established solid principles and to its experienced and trained staff, has always succeeded to overcome the difficulties it has faced. In 1963, the number of branches serving all around the country increased to 630.

Showing a rapid development in all fields, Ziraat Bank played a pioneering role to open a new era in Turkish agriculture upon the production of the first domestic tractor by a Turkish-American Company to which the Bank was a shareholder. The supports provided for the introduction of tractor and harvester era by abandoning local plows, for the utilization of chemical fertilizers instead of natural fertilizers, for supplying healthy and efficient seeds and for pesticide control are all the new steps and advances in this path. Support is provided for the investments made in field improvement and irrigation areas. The credits granted in the fruit growing sector help to develop fruit selling and to ensure export diversification. The resources needed by the cooperatives founded as a result of the organization of farmers are met by Bank’s facilities. Pasture improvement, development of cattle fattening and dairy farming, and establishment of the related industries are all ensured by providing aids for the importation of breeding animals. Encouraging loans in various sectors from beekeeping to sericulture are provided by Ziraat Bank’s facilities.

Financial support is provided for domestic production of agricultural machinery and implements which are desperately needed by villagers. In this way, modern agricultural machinery and implements that are seen only in the state farms become available for use in private agricultural lands thanks to cheap credit facilities of the Bank and has expanded rapidly. This has led to increased production, and the arable fields are made ready for planting again, which enable the farmers to obtain a 2nd crop.

Ziraat Bank, which has extended its services in order to become the bank of preference by everyone and all segments of population, continues to develop its operations in line with the aim to add value to the country.

Ziraat Bank, which was established in 1863 as a modest charity fund and which developed with great strides in time, is among the most valuable assets of the country today.

Milestones of Our Bank’s History

- Homeland Funds, the foundation of today's Ziraat Bank, is founded by Midhat Pasha in the town of Pirot (November 20).

- The first agricultural loan application is started, with a term of 3-12 months and a limit of 20 lira per person.

- Homeland Funds Regulations take effect.

- The first legislation in our country regulating organized credit systems.

- Government grants permission to two foreign citizens to found a Ziraat Bank in the vilayet of Edirne, however the venture proves unsuccessful.

- Bank makes first attempt to enter into foreign partnership.

- Benefit Funds replace Homeland Funds.

- "Benefit Share" duty added to the Ashar tax, providing the funds with a constant and stable financial resource.

- The funds take on a strong and permanent structure.

- Ziraat Bank Regulations take effect (August 28).

- Ziraat Bank General Directorate opens (September 17).

- Mikail Portakalyan appointed General Director of Ziraat Bank.

- First deposits accepted in return for interest.

- Ziraat Bank, with nominal capital of 10 million lira, comes under government auspices as a state institution controlled by the Ministry of Trade and Public Works.

- Bank inspection services start to be carried out by own inspectors.

- First loan to the Treasury.

- Bank activities come under more active supervision.

- Ziraat Bank Law is promulgated (March 23).

- Emil Kautz appointed as General Director.

- Cash advances granted to agricultural enterprises in return for loans, bonds, and securities.

- First government bond sale made.

- "Cash Deposit Notes", precursors to Certificates of Deposit, are issued.

- First mass postponement of agricultural receivables.

- First seed loans issued.

- Greek authorities occupying Izmir establish a separate Ziraat Bank Headquarters to control all branches and funds in occupied territory.

- Money was taken from Ziraat Bank funds and used to outfit the soldiers of the National Forces, formed during the War of Independence, meeting the corps' expenses.

- The occupation takes its toll on the bank organization.

- Parliament in Ankara announces that all branches and funds in territories under the Parliament's control are to be administered from the Ankara Branch of the Ziraat Bank (April 23).

- Thus, Ziraat Bank takes its place in the National Struggle.

- On June 23, 1920, Ahmet Kemal Ilgaz is appointed General Director.

- On December 6, 1920, Hüseyin Avni Şuşud is appointed General Director.

- Ankara takes control of Izmir operations (September 9). Ankara takes control of Istanbul operations.

- Success of the National Struggle reunifies the bank (October 23).

- Abdülkadir Zeki Güçlü is appointed General Director.

- On October 13, 1923, Emil Kautz is appointed General Director.

- First deposit receipts issued.

- Parliament enacts the Budget Law no. 444, with the purpose of freeing Ziraat Bank from the political control of governments who had used its resources to finance short-term requirements, returning the bank to the control and administration of its true owners the farmers, and expanding the activities of the bank that had previously been limited to agricultural loans (March 19).

- The bank's divisions are established as follows: General Assembly, General Assembly Investigators, Administrative Council, and Public Directorate.

- Prof. Leon Morf is appointed General Director.

- With the Budget Law, Ziraat Bank is converted from a state institution to a joint-stock company.

- "Law on the Organization, Administration and Audit of Entirely State-Capitalized Economic Entities" is passed to expand the authority of the General Assembly.

- The Board of Auditors provided for in Law no. 3202 is removed in Law no. 3460, with its duties transferred to the Prime Ministry Supreme Auditing Board.

- Nusret M. Meray appointed General Director.

- Bank comes under the supervision of what is now called the High Supervisory Council.

- The 198-article Charter of the Agricultural Bank of the Republic of Turkey (TCZB), for which Law no. 3202 had made provision, is completed and takes effect.

- The TCZB Charter puts on the agenda a substantial restructuring in the units of the General Directorate.

- The "Law on the Organization of the Inspection of Public Economic Enterprises by the Grand National Assembly of Turkey" brings the "General Assembly" into being, as well as the "Public Economic Enterprises Joint Commission" acting for Parliament.

- Duties of the Supreme Auditing Board are assumed by the Prime Ministry Public Supervisory Council.

- Hamburg agency is opened.

- In Cyprus, Lefkoşa (Nicosia), Gazimağusa (Famagusta), and Güzelyurt (Morphou) branches are opened.

- With a new Board of Directors decision, Regional Directorates were established in the Aegean (Izmir), Marmara (Istanbul), Central Anatolia (Ankara), East Anatolia (Erzurum) and Southeast Anatolia (Diyarbakır) regions "for the purpose of taking the necessary steps for the efficient and effective administration of Ziraat Bank's extensive countrywide organization, to closely monitor activities, and ensure that decisions taken at the General Directorate are implemented completely and correctly in the branches."

- Rise in branch numbers necessitates a transition from central to regional administration.

- Rahmi Önen is appointed General Director.

- Ziraat Bank Museum is opened in the General Directorate Honor Hall to exhibit our bank's history.

- Museum is the first banking museum in Turkey.

- New York agency becomes a branch.

- Duisburg, Berlin, Munich, Stuttgart, and Rotterdam agencies opened.

- "Bank 86" project, adapting developments in technology to banking services for faster, better quality, and more productive services, is introduced to 7 branches in Ankara and Istanbul, transitioning to an automated environment.

- Antalya and Mersin Free Zone branches founded.

- Southeast Anatolia Project (GAP) Directorate founded.

- Ş. Coşkun Ulusoy is appointed General Director.

- Loan support appropriate to aspects of the region starts to be provided to producers in the GAP region.

- Ziraat Bank ranks 452nd in Euromoney magazine's list of top 500 banks by equity capital

- A region is evaluated separately in agricultural support for the first time, laying the foundations of a new philosophy.

- School of Banking opened to train the quality personnel required by the bank.

- Through other participating banks led by Bankers Trust International, 140 million dollars of floating-rate bonds without Treasury guarantee payable in July 2001 were released.

- First Investment Fund (Fund I) established at our bank.

- Gold sales begin through Ziraat Altın.

- First consumer loans issued.

- First credit cards issued.

- Bingöl-Muş Agricultural Development Project started.

- Ankara, Istanbul, and Izmir Regions External Transactions Branches are connected to the General Directorate as "Remote Work Stations" on the SWIFT-1 System.

- Private Agricultural Loans, Personal Banking, and Bank Cards Directorates founded.

- "Self-Service Banking" application initiated.

- Along with ATMs, the project also featured the first Foreign Currency Exchange Machines, Self-Service Enquiry Terminal, and Audio Message Systems to be commissioned in Turkey, with the purpose of becoming the first 24-hour "Automated Electronic Branch."

- Bond purchases begin.

- Share trading begins.

- To protect customers of agricultural loans from the simultaneous failure of both creditors and guarantors to meet obligations, insurance starts to be provided through a protocol signed with Başak Insurance.

- Funds II, III, and IV founded.

- Dairy Farming Import Project started.

- Bank demonstrates interest in becoming effective in foreign transactions through transition to SWIFT, and aims to satisfy all segments of the population with new products.

- Istanbul Exchange Transactions Center opens as part of the Istanbul Branch.

- One year terms applied to agricultural sector business loans.

- Ziraat Bank Moscow, Kazkommerts Ziraat International Bank (KZI Bank), Turkmen Turkish Commercial Bank (TTC Bank) and Uzbekistan Turkish Bank (UT Bank) founded and opened.

- Ziraat Bank ranks 202nd in Euromoney's top 500 banks, 41st by net profit, world first in capital profit, and 12th among the 50 fastest growing banks in the world.

- "Ziraat 2001" project is started on the basis of open system architecture to utilize the developing technology of the day. The project is implemented in 86 branches in Ankara through Microsoft Windows NT and SQL databases.

- Sofia Branch opened.

- Stuttgart, Hannover, Frankfurt and Duisburg agencies begin functioning as branches. The bank's software drive facilitates the provision of new products and services.

- Number of affiliates reaches 21 by the end of 1999.

- Osman Tunaboylu is appointed General Director.

- Foreign currency indexed, spot and day loan applications begin.

- Skopje Branch is opened.

- Turkish-Ziraat Bank Bosnia D.D., under the coordination of Ziraat Kart A.Ş., obtains VISA and EUROPAY licensing to begin VISA acquiring and issuing transactions for the first time in Bosnia-Herzegovina.

- Berlin and Munich agencies become branches.

- Ziraat Bank's organizational network is further expanded.

- With Law no. 4603 passed on November 25, 2000; Ziraat Bank becomes a joint-stock company.

- Within the context of the restructuring of public banks, Ziraat Bank undergoes extensive changes starting in 2001.

- After the crisis in February 2001, public banks starts to be administered jointly by a board of directors led by Vural Akışık.

- Dr. Niyazi Erdoğan is appointed as Ziraat Bank General Director.

- Bank's organizational structure is completely transformed to meet the needs of modern banking and international competition.

- The notion of marketing is added to the bank's operation-focused approach.

- Emlak Bank is merged with Ziraat Bank and closed.

- 37 central branches are identified, and some centralized responsibilities delegated.

- Bank staff begins to be employed in line with private law provisions.

- Safa Ocak is appointed as Chairman of the Public Banks Joint Administration Board.

- First post-crisis loans are issued.

- M. Zeki Sayın is appointed as Chairman of the Public Banks Joint Administration Board.

- Can Akın Çağlar is appointed as General Manager of Ziraat Bank.

- Public Banks Joint Administration Board is closed having successfully completed its mission.

- Prof. Dr. İlhan Uludağ is appointed as Chairman of the Board of Ziraat Bank.

- Ziraat Bank enters its 145th year.

- Bank suffers the loss of Chairman of the Board Dr. İlhan Uludağ.

- Ziraat Bank opens branches in Athens and Gümülcine (Komotini), Greece.

- Profit of the Century from Ziraat: The bank announces profits of 3.55 billion TL, the largest profit made by any Turkish company to date.

- Ziraat Bank gains naming rights to the Turkish Cup.

- Muharrem Karslı is appointed as Chairman of the Board.

- Hüseyin Aydın is appointed as General Manager of Ziraat Bank.

- New Organizational Structure was introduced, Segmentation of Branch and Customer was made.

- Operations Center entered into service.

- 150th anniversary of foundation of " T.C. Ziraat Bankası" was celebrated.

- Branch of Batumi/Georgia was opened.

- The first syndication agreement in the history of "T.C. Ziraat Bankası" was signed.

- For the first time in the history of "T.C. Ziraat Bankası" issue of debenture stocks at the international markets was realized.

- Business activity permit for establishing Participation Bank was obtained.

- Ziraat Bank was the front-runner corporate taxpayer in 2014.

- Ziraat Participation Bank began its operations.

- Ziraat Bank Azerbaijan ASC began its operations.

- Ziraat Bank AD Montenegro began its operations.

- Ziraat Bank was nominated as the most robust 2nd Bank of Europe.

- The syndication agreement was signed for the 3rd time (1.1 billion USD - with the participation of 41 banks)